The news of WeWork, a global co-working space company, nearing bankruptcy has served as a wake-up call for both investors and startups. Once valued at 62 trillion won, the company has recently hired bankruptcy experts after a string of executives departed, citing a disconnect between the company's vision and strategy. What's surprising is that WeWork has been consistently in the red for eight years since its financial disclosure. This reveals the limitations of its business model, which, despite its tech company self-image, is essentially no different from the traditional real estate leasing business.

Criticism of Adam Neumann, the founder often cited as the cause of WeWork's rise and fall, continues even after he left the company in 2019.

Eliot Brown, the author of "The Cult of We" and a WSJ journalist, summarized WeWork as a prime example of the cultural insensitivity surrounding contemporary IT startup investments in an interview with Wired. He points out that for over a decade, investors were consistently persuaded by Adam Neumann's repetitive pitch, despite WeWork's fundamentally flawed structure as a poorly managed real estate company. This claim was based on the assertion that WeWork possessed the characteristics of a high-growth tech company. The criticism and regret of these investors towards Adam Neumann culminated in SoftBank CEO Masayoshi Son's decision to strip him of control in 2016, after having poured funds into WeWork since then. However, Adam Neumann ultimately made a substantial profit throughout this process, while investors lost money.

Why did these investors continue to invest in WeWork, even after multiple crises and without any visible business results? Is the critical view of founder Adam Neumann insufficient to explain this? I contend that the answer might lie in the 'Unmet needs' embedded in WeWork's pitch deck, which may have fueled investor expectations. In other words, I wonder if the distinction between unmet needs, which is a value proposition focused on current deficiencies rooted in design thinking, and the fact that investors' investments are essentially bets on the future, wasn't properly understood.

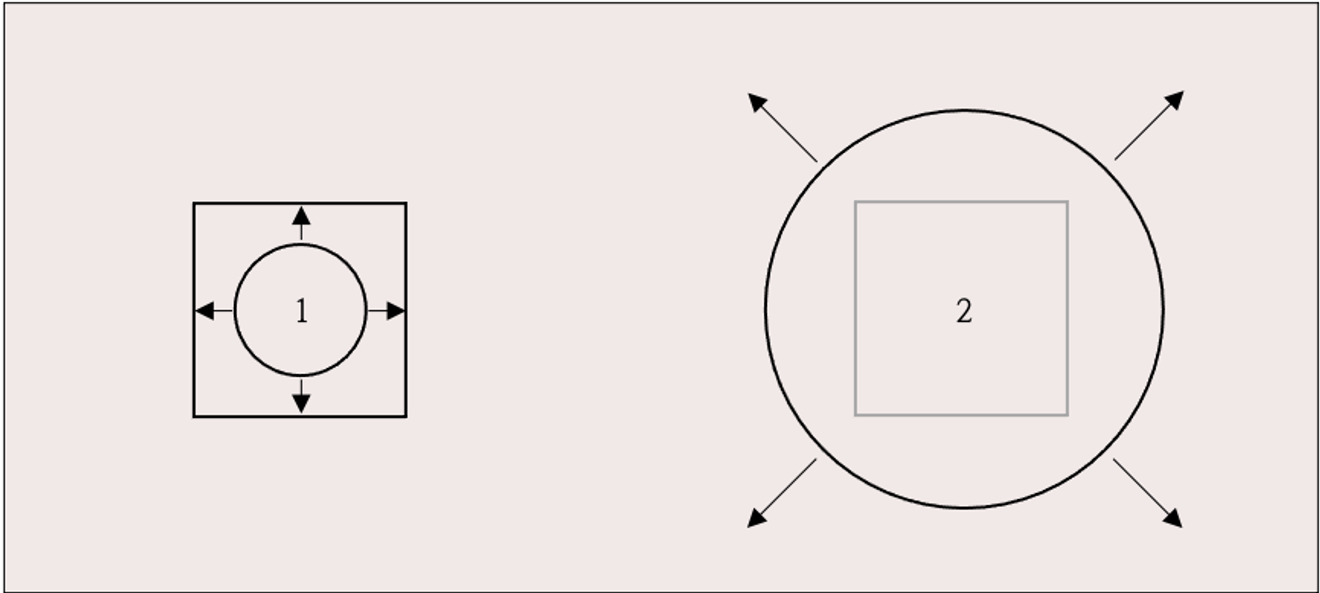

1. Difference between Unmet needs and 2. Overmet needs

The design thinking approach, which has dominated the business world for the past 20 years, often assumes that the value of a product or service stems from consumer interaction. Furthermore, a widespread belief that focusing solely on the user to identify unmet needs significantly increases the chance of success leads toa tendency to remain within the current framework associated with the product. This approach and perspective also simplifies the human experience, reducing individuals to users with tasks or actions to perform. This simplification obscures the efforts within the larger sociocultural reality in which people experience and ascribe meaning to products and services, potentially creating problems instead.

People experience things in far more diverse ways, influenced by their personal histories, memories, social characteristics, preferences, and symbols gleaned from their lives. This value structure is also a way we experience and collectively assign value or empathy to products and services. Therefore, our understanding of value must encompass not only individual 'users' but also the broader dynamics of evolving human experiences. Thus, the limitations of user- and interaction-based transactional models centered on products and services become more apparent when predicting future market trends. This can introduce substantial uncertainty for investors seeking undervalued companies or early-stage investment opportunities. For them, knowing where to invest without understanding the changes in this world is simply frightening.

In this regard, it is necessary for investors, who have previously focused on the 'discovery' of new and innovative current value propositions, to examine the following points to confirm whether the value is sustainable.

Firstly, it is crucial to critically evaluate the 'power of process.' The step-by-step methodology for planning and creating current products or services, including empathizing, defining, ideating, prototyping, and testing, is a familiar approach taught in business schools and practiced in the industry. This method undoubtedly offers advantages by clarifying the distinctions between concepts and providing a practical foundation for progress. However, it can sometimes prematurely force ideas to conform to existing paradigms, potentially leading to poor investment decisions.

Adding a process during the R&D stage to identify the broader range of elements that constitute human experience and how they are interconnected may seem like a factor that merely slows down the pace of business operations. However, if we verify and understand the path we are taking in advance, it can minimize trial and error and lead to the fastest route to the destination.

Secondly, it is important to reconsider the value propositions deemed 'familiar' within each industry. By questioning and re-examining the entirety of the world in which value has been established, it becomes possible to identify familiar values rather than simply discover unfamiliar ones. This can lead to opportunities for clear and lasting value propositions. For instance, Ford, instead of solely focusing on payload and engine performance improvements, identified various situational aspects of using cars at home. This enabled them to concentrate on features that support a satisfying user experience and the development of new vehicle categories, rather than investing in familiar, low-frequency, and high-cost features.

Making sound investment decisions requires not only identifying current unmet needs but also gaining a deeper understanding of how people live their lives across various personal, public, social, and cultural dimensions, thus confirming the flow of more sustainable value structure changes. Both the discovery of Unmet needs that chase specific deficiencies and the revelation of Overmet needs that expose familiar yet altered values can contribute to this process.

*This article is the original content of a named column published in the Electronic Times on September 11, 2023.

References

Comments0