"The very idea of cryptocurrency being on trial is ludicrous. It's individuals who are on trial."

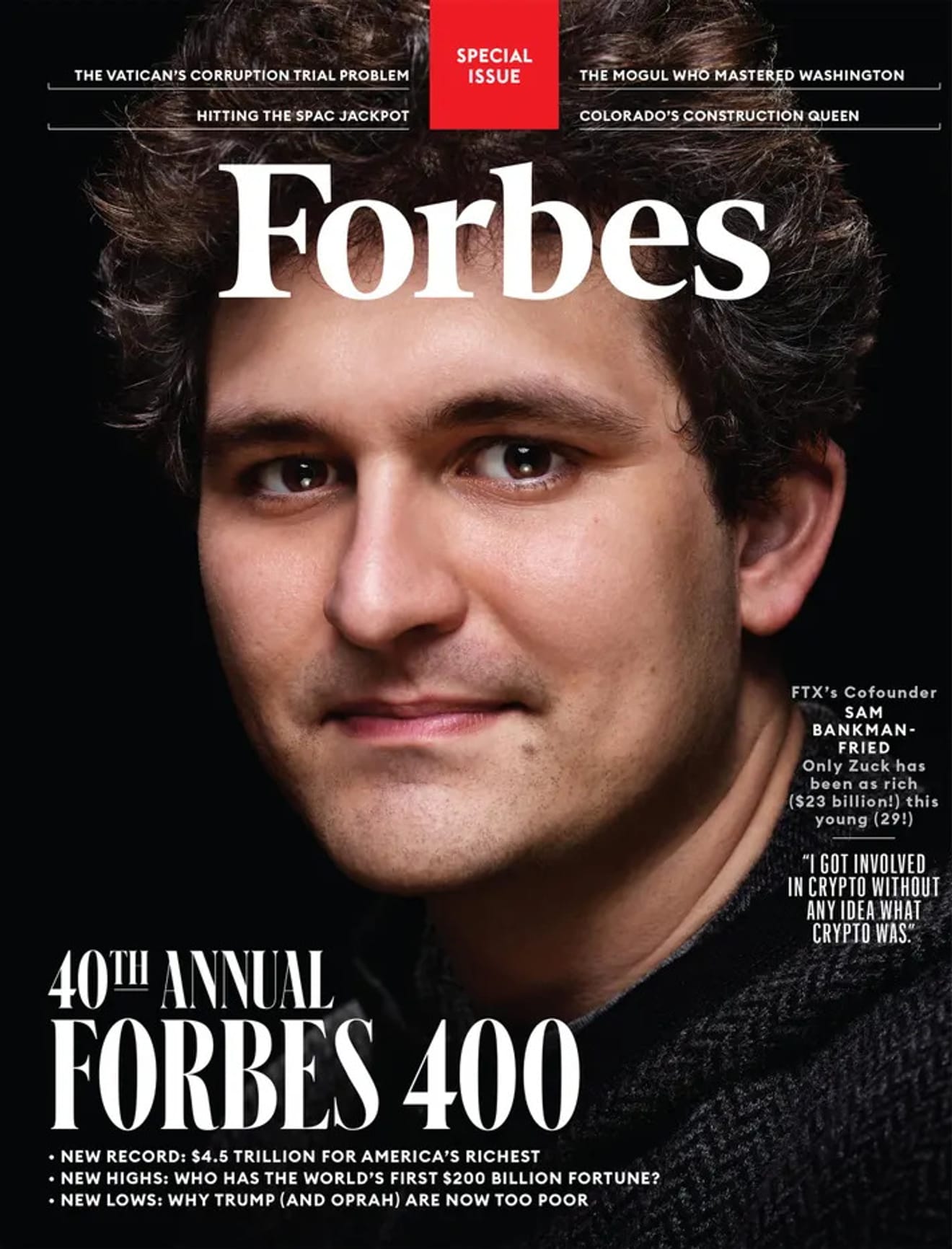

Sheila Warren, CEO of the Crypto Council for Innovation, an advocacy group for cryptocurrency regulation, expressed her discomfort with the trial of Sam Bankman-Fried, the founder of FTX, which began on October 3rd, and the negative public reaction towards the industry in an interview with the media. The local media's coverage of the trial, which will span six weeks and address seven criminal charges, has focused on negative headlines, a stark contrast to their previous heroic portrayals of Sam Bankman-Fried as an individual.

Of course, the focus of this trial should be on the victims' voices and concrete details regarding the restoration of damages. However, in the case of FTX, which enjoyed immense popularity, what lessons can the industry and victims truly learn from this perspective, which is solely centered on individual responsibility?

At one point, FTX was heralded as the future of cryptocurrency, and cryptocurrency was portrayed as the future of currency. Moreover, FTX, which had pledged to sponsor college scholarships and fund charitable projects, was able to solidify its longevity by sharing the stage with powerful figures through its relationships with key political donors and lobbyists. And in recent books published by two authors who covered FTX's growth and subsequent downfall, we can find clues to the aforementioned lessons.

Michael Lewis, author of Going Infinite, released on October 3rd, is a best-selling author and renowned financial journalist known for works like 'Moneyball' and 'The Big Short.' Apple paid $5 million for the rights to his unpublished new book, highlighting the intense anticipation and interest surrounding his FTX coverage. And Zeke Faux, author of Number Go Up and an investigative reporter at Bloomberg, confessed that, like Michael Lewis, he began his investigation with a focus on and fascination with the founder, Sam Bankman-Fried.

However, while Michael Lewis maintained a sympathetic stance towards Sam Bankman-Fried in several media interviews, arguing that FTX was a genuinely good business, Zeke Faux reveals that he didn't even consider closely investigating how FTX operated as a business, showcasing a growing difference in the direction of their books. Consequently, Going Infinite retains a structure that does not significantly differ from the already widely reported content that focused on the FTX founder's personal characteristics as an innovator. In contrast, Number Go Up introduces more cryptocurrency eccentrics and examines FTX within a broader context, touching on topics such as the stablecoin Tether, the so-called 'pig butchering scam,' and journeys to Cambodia, a hotbed for hybrid scams combining romance scams and cryptocurrency fraud.

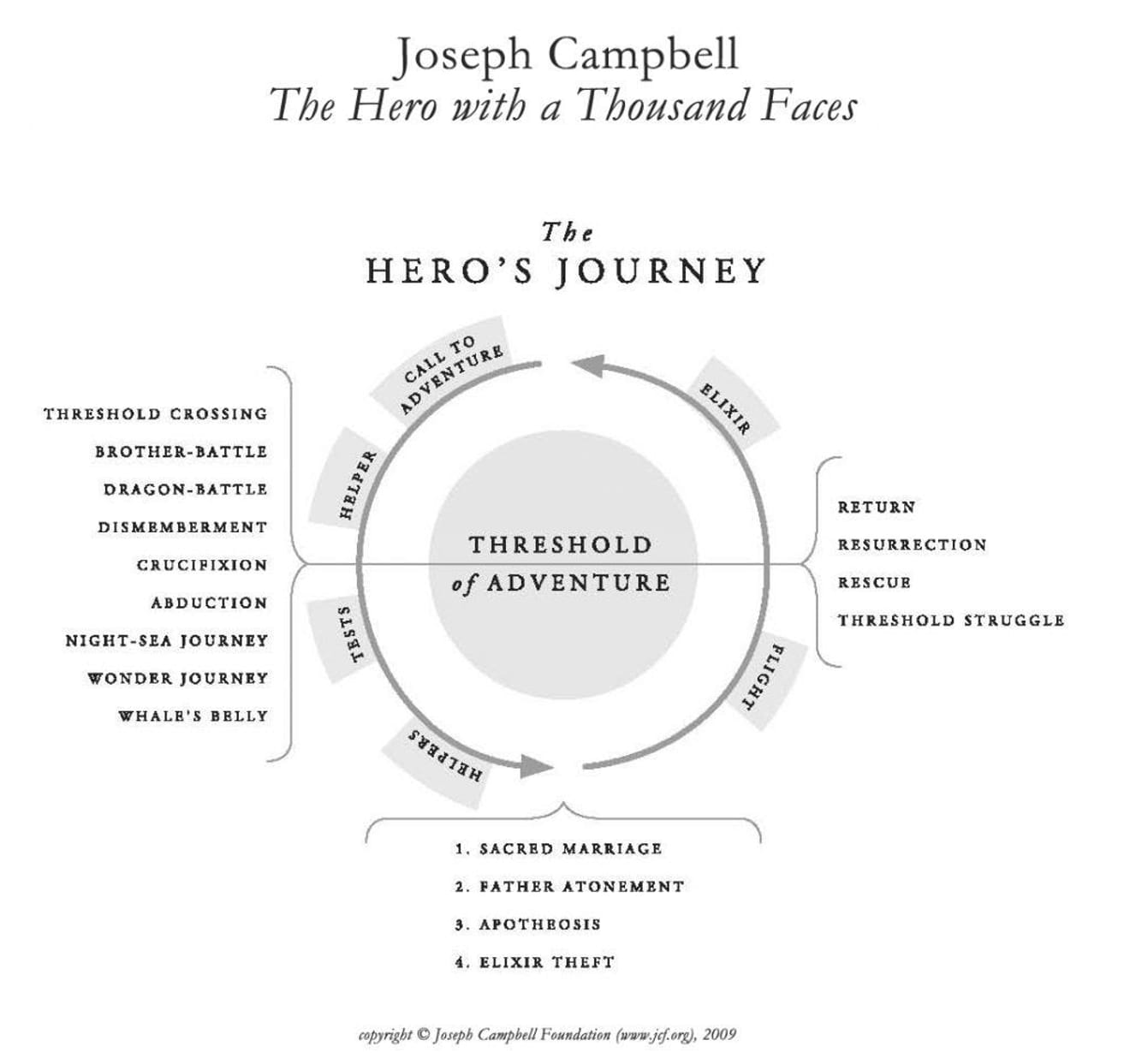

FTX was once considered a prime example of innovation. However, there's an aspect wherethe world has forgotten how to see the complete narrative, overly focused on the introduction and departure of the heroin the heroic narrative of innovators. In 1949, Joseph Campbell, after analyzing biographies of global heroes, concluded that the core of every hero's journey was the acquisition of a new kind of ability through trials and hardships, returning to bring change to the status quo.

In essence, the hero's journey is merely a recipe for challenging systems. Itimplies that a hero must leave their system, pass through another, and return with the resources necessary to alter the system in order to actually change it. The beginning of FTX, heralding a significant transformation, quite aligns with the characteristics of a potential hero due to the founder's eccentric personality.

He presented himself as an academic, passionate about effective altruism, with a partially bald head, which seemed relatively uncouth and unusual within the industry. Moreover, the fact that his parents were Stanford Law professors and his casual attire while talking to investors while playing video games effectively instilled the perception of a typical tech genius, aided by media portrayals. However, external validation and attention to his ability to establish a new system and effectively integrate resources from the existing system after experiencing the limitations of the existing system did not reach the necessary level.

Did FTX possess the resources necessary to alter the entire system? Before enthusiastically sharing the potential of a new system, to what extent did Sam Bankman-Fried deeply understand the existing system and consider its points of contact with the new system? Had there been more focused attention and scrutiny on this question, could the tears of countless victims have been prevented?

As if answering this question, Zeke Faux, author of Number Go Up, introduced Sam Bankman-Fried's delusion within the operating principles of cryptocurrency returns in a Bloomberg podcast episode hosted by his colleague, Levin, with the following dialogue.

"You start with a company that makes boxes… The company can hype up how this box can change lives, but nobody actually knows or cares what the box does… The important thing is, if you use that excitement to introduce how the company issues tokens to share that profit, that excitement builds up, and the price keeps going up infinitely. Then everyone makes money."

References

Comments0