In May 2020, an investor consortium including PensionDanmark and PFA, one of the top 50 pension funds in Europe and a leader in sustainable impact investing, decided to invest over €50 million in the VindØ ('Wind Island') project, the world's first artificial energy island. This project, a cornerstone of the Danish government's climate action plan, was expected to reach a 3GW offshore wind capacity by 2030 and ultimately provide 10GW of offshore wind, equivalent to 25 conventional offshore wind farms.

However, PFA, one of the core investor companies, is currently hesitant to invest in the project, despite the return of the Danish offshore wind auction. This decision comes amid political changes and market stagnation. Saadia Madsbjerg, author of 'Making Money Moral', while welcoming the surge in impact investing that advocates for better social change and sustainability, pointed out that both investors and companies lack relevant field experience, making it difficult to continuously manage risks and generate value.

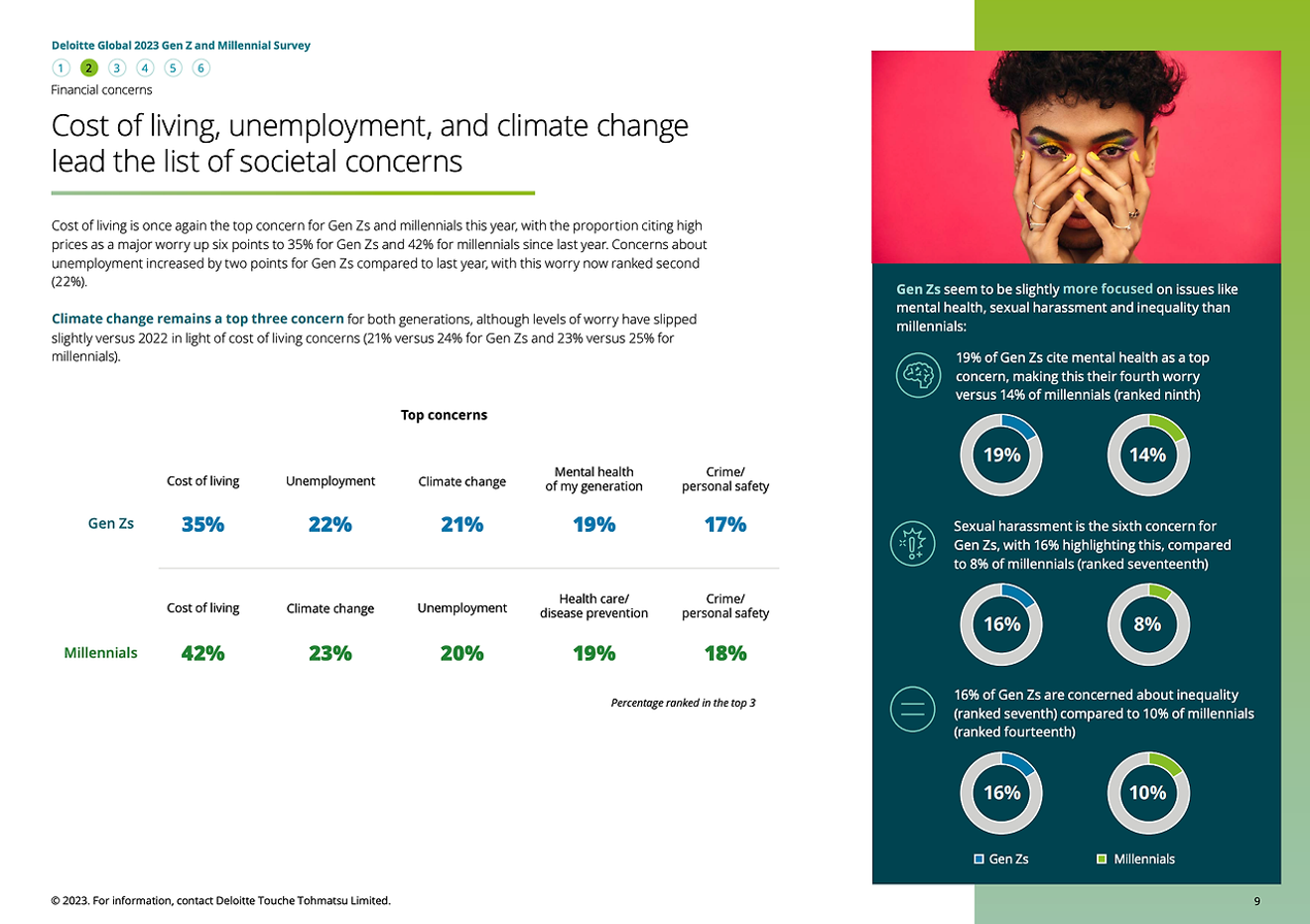

Of course, it has become clear that climate change is already having a direct impact on reality. According to a Deloitte report on Gen Z and Millennials titled '2023 Global Trends Shaping the Future of Work', 60% of respondents reported experiencing anxiety about environmental changes, and they actively consider the employing company's response and evaluation of these changes when deciding whether to stay or leave.

However, the related investment opportunities presented as solutions to this problemmust be based on the premise of continuously convincing both individual investors and companies of their future profitability and the value of the investment. How can we maintain both corporate and individual expectations for these slowly evolving, abstract results?

In this regard, I suggest starting by acknowledging that the term 'sustainability' is perceived and used differently by companies and investors.

Impact investors identify investment opportunities using a lens of social themes such as underserved markets, health and well-being, and education and technology,but individual investors are simply people who engage in small, personal actions. Furthermore, individuals within organizations and institutions have long talked about sustainability as if it were a widely accepted, visible understanding of something that is feasible on a large scale through products and policies.'Sustainable value', 'Sustainability proposition', 'Achieving true sustainability', 'The impact of sustainability,' and so on. However,individuals talk about small, personal actions that make them feel like they are 'doing good' such as recycling, plant-based diets, local shopping, and worker rights, on a daily, human scale, but struggle to explain the meaning of this expression.

In other words, there is a significant difference between companies and individual investors in their understanding of value, as evidenced by their different spheres of ideals and practices. This suggests that organizations truly concerned with the impact of large-scale sustainability need to begin by understanding the practices and beliefs of individuals who shape what is feasible in everyday life. That is,sustainability is addressed on a global scale, but the complexity of individual actions can only be understood on a human scale.

In a 2020 sustainability study, qualitative research expert Lee Ryan reported that while professionals can point out the discrepancy between intentions and actions regarding sustainability, the individuals participating in the study felt justified in doing their best to make their small world a slightly better place. They don't feel small or guilty in front of the grand narrative of 'sustainability'. Furthermore, while companies tend to focus on bright and optimistic futures when discussing sustainability in various business activities,there is a difference in that individuals in reality want to be optimistic but experience a kind of sadness as they look towards a bleak future.

We already know that the natural environment our children will face in the future will be worse than it is now. Therefore, we need to remember that corporate slogans that focus on optimism can stimulate both the hope of individual investors who want to be part of the solution to the current situation and the realization that even the current state may not be maintained, making them feel more complex and cautious about related investments.

Sustainability is a global challenge. However, people don't use the term 'sustain' in everyday conversation while simultaneously thinking about sustainability and unsustainability. They also don't question who or what can be sustained. Therefore, perhaps'viability' is a more appropriate term for the general public and individual investors. We strive to live for survival, and humans have continuously adopted and adapted to behaviors necessary for survival, making this a worthwhile suggestion to consider.

In other words, it's not just survival of the fittest, butthe sustainability of survival of the fittest.If investment is an action for a better future, then in the future, investment firms and companies may find that starting with investing in the keyword 'viability' to encourage the participation of individuals is a better choice.

P.S. I've noticed that the number of likes on my posts is higher than the number of views. While I don't write posts that are meant to be popular, I feel that my posts are too valuable to receive likes from those who don't even read them. I would appreciate it if only those who like my posts would respond to them.

*This article is the original content of a named column published in the Electronic Times on September 26, 2023.

References

Comments0